Tuesday, August 31, 2010

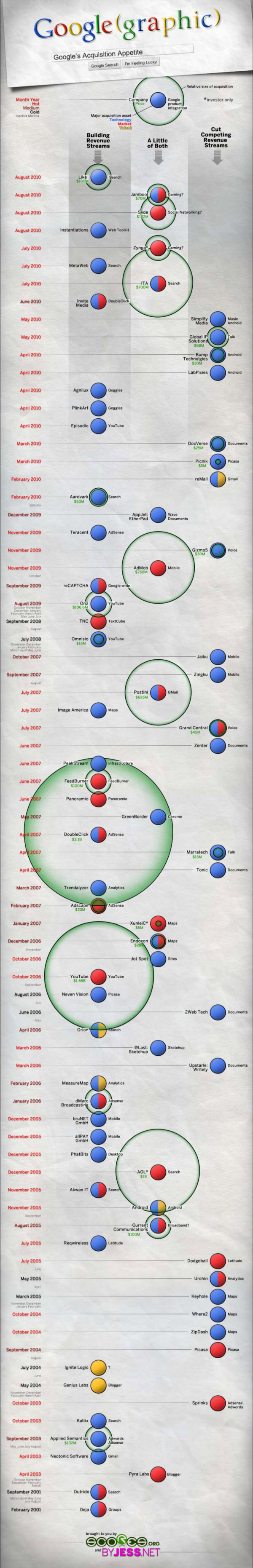

Google's Acquisitions

Thursday, August 26, 2010

TD-LTE: an introduction

Defining TD-LTE:

LTE (Long Term Evolution) is the fundamental and primary technology for the development of 4G technology, which is an evolution of 3G networks. TDD (Time Division Duplex) version of LTE is called TD-LTE. It was developed by China Mobile in the recent years.

TD-LTE explained:

TD-LTE allows carriers to make use of unpaired spectrum that many of them already own. Compared to the previous standards GSM, EDGE, etc., TD-LTE's commercial release time period is very short, due to its later addition into the standards.

There are some essential similarities and differences between TD-LTE and classic LTE. Basically LTE has the following characteristics:

- Much faster upload and download speeds than the 3G.

- It can reach download speeds of over 150 Mbit/s and upload speeds of over 80 Mbits/s.

- It has a larger cell size where a single LTE cell tower can cover upto 100km. Although its size will be greatly diminished in urban areas, it is still a lot better than 3G.

- It can easily be upgraded as it was developed with the intention of making the implementation of upgrades easier down the line.

- It has a great advantage of being compatible with existing standards.

Differences and similarities between LTE and TD-LTE:

- They run on different bands of wireless spectrum. But the part of spectrum that carries the TD-LTE signal is a lot cheaper and has much less traffic.

- LTE and TD-LTE are so similar that both the networks can be accessed by the same chip, which is easier for handset manufacturers.

- 4G, WiMAX standards are not compatible with LTE, but compatible with TD-LTE.

TD-LTE technical specifications:

- TD-LTE is specified to operate in the frequency range of 1850 to 2620 MHz.

- It uses the same MIMO (Multiple Input, Multiple Output) scenarios.

- There are two frame configurations, each with an overall length of 10 milliseconds and divided into 10 subframes as shown in the figure above.

- That is, the transmitted signal is organized into subframes of 1 millisecond.

- There is only one single carrier frequency and the transmissions (uplink and downlink) in the cell are always separated in time.

- The 5ms version has two special subframes when compared to one in the 10ms version which provides greater chances of uplink/downlink flexibility.

- The frame can be dynamically configured to any one of the above depending upon the transmission requirement.

- Each one millisecond downlink subframe contains blocks of data called “Resource Blocks” meant for a number of different users.

- Uplink subframe contains blocks of data from the users to the Base Station.

- The specified latency time is 5 ms or only half a frame for small data packets.

- The current system is made such that the stationary or pedestrian users or the low speed users experience operations done at the highest speed.

- There is no need to develop new devices for using TD-LTE. It's enough to add TD-LTE support to the existing devices.

- There is a lot of TDD spectrum available and it is cheap in cost.

- The increasing availability allows transition of WiMAX (Worldwide interoperability for Microwave Access) operators to TD-LTE using the same allocated spectrum.

- Industry commitment is great without any limitations.

TD-LTE will bring in new challenges to developers and vendors of design. New schemes, new configurations, higher system bandwidths, higher system capacity, lower latency are some of the expected challenges. There is a prediction that there will be 30 to 80 million subscribers and over £70 billion in operator revenues within 5 years.

Sunday, August 15, 2010

FTTH and LTE help increase focus on wholesale

- Results: incumbents (KPN, DT, BT, Telefonica, Belgacom, FT, Bell Aliant), mobile (Sprint), cablecos (Liberty Global, Telenet, Ziggo, Virgin Media, ONO, Comcast).

- Financing: Reggefiber got its desired EUR 130m loan from the EIB.

- IPO: Skype's $100m plan.

- M&A: possible buyers (Telefonica, PT, Vodafone, FT, TI) and sellers (PT, TI, Vodafone).

- FTTH: lots of deployments announced (inclusing China and India).

- NBNs and NBPs: Australia expands coverage plans to 93%, New Zealand receives 15 bids, the US awards another round of funds.

- LTE: several deployments announced.

- 4G: Clearwire moving closer to switching from WiMAX to LTE and the WiMAX2 standard gets ready for a 2012 launch.

- 1 Gbps: several MSO and telcos are now going beyond 100 Mbps, while ever more are eying 1 Gbps as the new frontier for bandwidth.

- Structural separation: proposal from Telecom NZ in order to be able to bid for the Crown Fibre plan.

- MVNO: KPN reports success with foreign MVNO operations (2G, 3G); Econet plans launch on the Everything Everywhere network (3G); Best Buy will do the same on the Clearwire network (WiMAX); Airspan is LightSquared's first wholesale customer (LTE); Tele2 NL started offering CATV on the networks of Ziggo and UPC (analogue TV); Chile considers a wholesale-only network (mobile and digital TV).

- BT was not allowed to raise wholesale prices to help stem the pension fund deficit.

- Apps: Google ended the development of Google Wave and acquired Slide; Samsung announced a developer contest.

- Net neutrality: Google and Verizon struck an agreement.

- Hybrid TV: Apple was rumoured to rework Apple TV into iTV, Cox partnered with TiVo and the Virgin UK/TiVo partnership added Cisco.

- The focus in the sector is shifting to Wholesale and OTT; FTTH and LTE are ongoing; wholesale is established as an important new business.

- M&A is focused on emerging markets, esp. Latam.

- Many incumbent telcos are still assembling global empires in order to be able to show growth. KPN is continuing on the wholesale path for growth.

- A telecoms network can be looked at as a vital piece of national infrastructure. If structurally separated, its cash flows can be seen as a vital element of the governments budget (incl. retirement funding).

- Cablecos are outperforming telcos. If you split the business three ways, it becomes clear why. 1. Connectivity (access): Docsis 3 outperforms xDSL and provides cable with a growth engine. Utility rates are close to 80% in the Netherlands, still much higher than FTTH's. 2. Communication: a nice add-on for growth and loyalty, hitting incumbent telcos in their hearts. 3. VAS (incl. content): here cable is the incumbent and benefits from a considerable head-start on multiple fronts (network, digital services, content deals). The foremost risks include FTTH and non-linear TV/hybrid TV/OTT.

- NGNs (FTTH, LTE) are exploring their advantages: 1. Maximum symmetrical bandwidth. 2. Lowest opex, highest score on the green scale. 3. Options for open access and wholesale.

- OTT is a complex and uncertain field, but hybrid TV seems to be a promising direction.